"Last week the Federal Reserve released the results of the latest Survey of Consumer Finances, a triennial report on the assets and liabilities of American households. The bottom line is that there has been basically no wealth creation at all since the turn of the millennium: the net worth of the average American household, adjusted for inflation, is lower now than it was in 2001."No real wealth was created, just a housing bubble and tax cuts which just preserve the wealth that people already have. All this sideways action as the world's economies grew massively, China and Europe in particular. It was not until our housing bubble with its securitized mortgages, bad loans, bogus risk ratings and toxic derivatives were spread around the world by our banks and investment houses that the US was able to knock them down a few pegs.

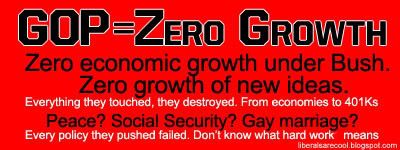

"Yet until very recently Americans believed they were getting richer, because they received statements saying that their houses and stock portfolios were appreciating in value faster than their debts were increasing. And if the belief of many Americans that they could count on capital gains forever sounds naïve, it’s worth remembering just how many influential voices — notably in right-leaning publications like The Wall Street Journal, Forbes and National Review — promoted that belief, and ridiculed those who worried about low savings and high levels of debt."And the Republicans still walk around DC as if the don't have stench of failure reeking from every pore. Your legacy of zero growth, both monetarily and intellectually, is undeniable.

Source: Paul Krugman

No comments:

Post a Comment